Search

Islamic Finance MSc Progression Route

Candidates who have successfully completed the Advanced Diploma in Islamic Finance (ADIF) qualification will be eligible to enrol on this MSc Islamic Finance degree.

Course code

FBLT047

Location

100% online study

Study mode

Part-time

Duration

1 year part-time

Fees

£9500

Start date

January 2025

Course overview

Candidates who have successfully completed the Advanced Diploma in Islamic Finance (ADIF) qualification will be eligible to enrol on this MSc Islamic Finance degree.

This course has been developed in partnership with the Bahrain Institute of Banking and Finance.

Course detail

The first delivery of modules will be in January 2025 during which you will complete the following modules:

Semester One

Behavioural Finance

This module teaches students about how psychological and sociological factors influence financial decision-making. The module will enable them to identify possible biases in investment analysis and portfolio management arising from cognitive, affective and social influences.

Governance, Accountability and Ethics

This module aims to provide students with a framework to examine the key issues in corporate governance. These include underlying corporate governance theory and associated reporting and regulation, the role of monitors and issues of independence and ethics. It also develops students’ ability to critically appraise relevant academic literature and current issues and integrate and synthesise topics in order to participate in current debates and suggest potential insights for development.

Entrepreneurial Practice

The programme incorporates a Chartered Management Institute (CMI) accredited module, Entrepreneurial Practice. Students who successfully complete the module and meet the CMI evidence requirements will gain a Level 7 Certificate in Strategic Leadership and Management and a Level 7 Award in Professional Consulting.

The aim of this module is to provide students with a framework of knowledge and understanding of how to effectively lead and develop people in a strategic and entrepreneurial way. Students will explore the influence and impact of leadership theories, culture, wellbeing, the principles of entrepreneurial practice and understand the different contexts in which entrepreneurship can flourish as well as the characteristics of entrepreneurial leadership within different types of organisational scenarios.

Ultimately, students will be given the opportunity to develop their strategic priorities for entrepreneurial leadership.

Ultimately, students will be given the opportunity to develop an innovative framework to deliver a change management strategy in a changing organisational context.

Finally, the module requires students to reflect critically on their personal learning and development needs and how they work with others, from an ethical and professional standpoint to encourage their continuing professional development.

Semester Two

Corporate Finance

This module examines and critiques key corporate finance issues, including financial management, risk and return, corporate financing and asset pricing, capital structure and payout policy. The module takes an international perspective and explores both theoretical models and empirical evidence.

Quantitative Methods

This module covers some of the quantitative techniques commonly used by financial analysts, economists, accountants as well as individual investors. The aim is to give students the basic grounding in econometric methods used in the analysis of quantitative data. The module will primarily focus on the statistical techniques of estimation, hypothesis testing and modelling using economic and financial data in which they will learn about economic software.

Semester Three

Project

In this module students will carry out a substantive piece of independent research into a business issue relevant to their course of study. Students will be expected to draw upon the knowledge acquired, and the intellectual, technical and analytical skills developed throughout their course. To equip students with the additional research skills required to successfully execute the research, they will be supported by a series of workshops on research methods. Students will be supported in this module through a series of group supervisions, and will be allocated a project supervisor.

The module includes three routes, and students will be given the opportunity to select their preferred route, although all project titles must be approved by the project supervisor in advance of commencing the project.

The three routes are:

- Route 1: An individual research-based dissertation;

- Route 2: An individual project report;

- Route 3: A group project report. Where work is completed as part of a group, each group may have no more than five members.

Successful completion of the above modules will enable students to qualify for an MSc in Islamic Finance awarded by Coventry University.

For further details about this top-up course, please direct enquiries to Dr Aqsa Aziz, Course Director.

Assessment

Coursework, examination, one of individual dissertation, individual project report or group project report.

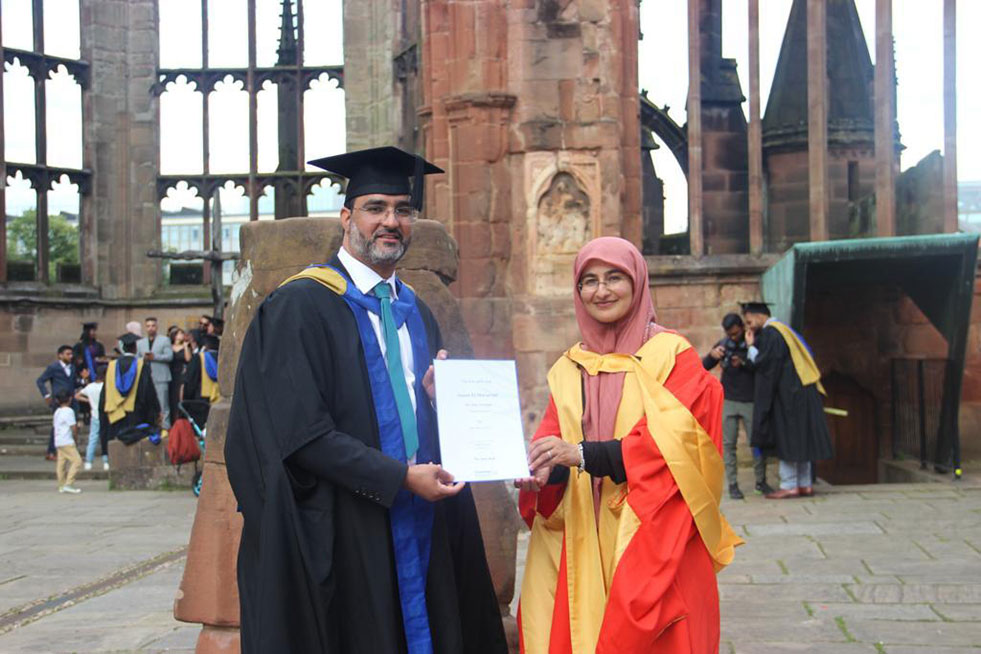

My dream come true by celebrating my achievement of completing my master degree in Islamic finance, Thank you Coventry University for arranging our graduation ceremony which was very smooth and well organised and a special thanks to our super hero Dr Aqsa Aziz for her unlimited support.

Maryam Abdullah, Islamic Finance MSc Progression Route graduate, quoted in 2023

Course dates

Semester 1: 20th January - 18th April 2025

- 7023EFA - Behavioural Finance

- 7029EFA - Governance, Accountability and Ethics

- 7050CRB - Entrepreneurial Practice

Semester 2: 19th May - 15th August 2025

- 7002EFA - Corporate Finance

- 7005EFA - Quantitative Methods

Semester 3: 15th September - 12th December 2025

- 7055EFA - Project

How to apply

Apply NowPlease note this course is only open to candidates holding the Advanced Diploma in Islamic Finance.

Throughout the program, I was impressed by the high calibre of the faculty and the curriculum, which provided a rigorous and comprehensive understanding of finance and its applications in the real world. The structure of the program, with its emphasis on self-directed learning and collaborative projects, allowed me to develop important skills that I look forward to applying in the years to come.

Yousif Ahmed Al Hamar, Islamic Finance MSc Progression Route graduate, quoted in 2023

-

Disclaimers

Coventry University together with Coventry University London, Coventry University Wrocław, CU Coventry, CU London, CU Scarborough, and Coventry University Online come together to form part of the Coventry University Group (the University) with all degrees awarded by Coventry University.

1Accreditations

The majority of our courses have been formally recognised by professional bodies, which means the courses have been reviewed and tested to ensure they reach a set standard. In some instances, studying on an accredited course can give you additional benefits such as exemptions from professional exams (subject to availability, fees may apply). Accreditations, partnerships, exemptions and memberships shall be renewed in accordance with the relevant bodies’ standard review process and subject to the university maintaining the same high standards of course delivery.

2UK and international opportunities

Please note that we are unable to guarantee any UK or international opportunities (whether required or optional) such as internships, work experience, field trips, conferences, placements or study abroad opportunities and that all such opportunities may be unpaid and/or subject to additional costs (which could include, but is not limited to, equipment, materials, bench fees, studio or facilities hire, travel, accommodation and visas), competitive application, availability and/or meeting any applicable travel, public authority guidance, decisions or orders and visa requirements. To ensure that you fully understand any visa requirements, please contact the International Office.

3Tuition fees

The University will charge the tuition fees that are stated in the above table for the first Academic Year of study. The University will review tuition fees each year. For UK (home) students, if Parliament permit an increase in tuition fees, the University may increase fees for each subsequent year of study in line with any such changes. Note that any increase is expected to be in line with inflation.

For international students, we may increase fees each year, but such increases will be no more than 5% above inflation. If you defer your course start date or have to extend your studies beyond the normal duration of the course (e.g. to repeat a year or resit examinations) the University reserves the right to charge you fees at a higher rate and/or in accordance with any legislative changes during the additional period of study.

4Facilities

Facilities are subject to availability. Access to some facilities (including some teaching and learning spaces) may vary from those advertised and/or may have reduced availability or restrictions where the university is following public authority guidance, decisions or orders.

Student Contract

By accepting your offer of a place and enrolling with us, a Student Contract will be formed between you and the university. A copy of the current 2025/2026 contract is available on the website. The Contract details your rights and the obligations you will be bound by during your time as a student and contains the obligations that the university will owe to you. You should read the Contract before you accept an offer of a place and before you enrol at the university.